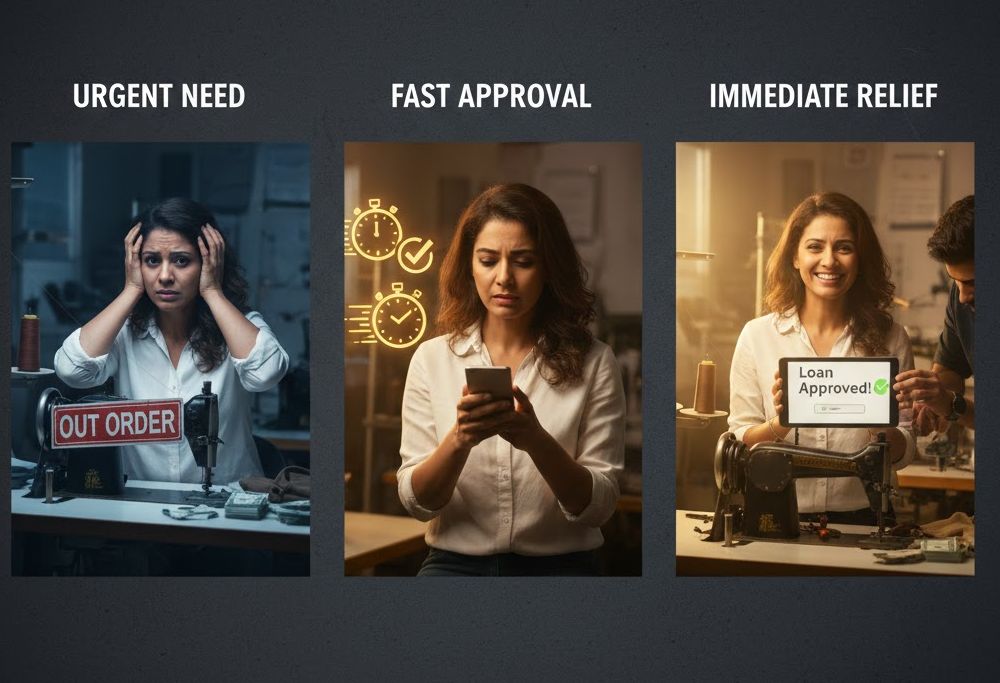

Emergency business loans are financing options designed to get capital into your hands within 24 to 48 hours when unexpected situations demand immediate action.

Unlike traditional bank loans that take weeks to process, emergency funding prioritizes speed over everything else.

The application is streamlined, documentation requirements are minimal, and approval decisions happen in hours.

Whether you’re facing equipment failure, a sudden cash flow gap, an unexpected expense, or a time-sensitive opportunity, emergency loans exist to bridge the gap between what you need and what your current cash reserves can cover.

Qualification focuses on revenue and cash flow rather than perfect credit.

Get Your Free Quote

What Are Emergency Business Loans

An emergency business loan isn’t a distinct product category so much as a way of describing fast-access financing used for urgent needs. Several products can serve this purpose: short-term loans, lines of credit, merchant cash advances, and invoice factoring all qualify when speed is the priority.

What sets emergency funding apart is the timeline. Traditional lending operates on the bank’s schedule. You apply, wait, provide more documentation, wait some more, maybe get approved, wait for funding. The whole process can take a month or longer.

Emergency lending operates on your schedule. You have a problem that needs solving today or tomorrow. The right lender gets you from application to funded in hours, not weeks.

The Federal Reserve’s 2024 Small Business Credit Survey found that 59% of small businesses experienced financial challenges in the prior year, with cash flow gaps being the most commonly cited issue. When those gaps turn into crises, emergency funding becomes essential.

Speed comes with trade-offs. Emergency loans typically carry higher rates than you’d get with patient, well-planned borrowing. Lenders charge a premium for accessibility and fast turnaround. The question isn’t whether emergency funding costs more. It’s whether the cost is worth solving your immediate problem.

Common Business Emergencies Requiring Fast Capital

Emergencies come in many forms. Some are predictable in hindsight. Others blindside even well-prepared business owners.

Equipment Failure

Your oven, truck, CNC machine, refrigeration unit, or critical computer system dies. Operations stop or slow dramatically. Every day without that equipment costs money. Waiting weeks for a bank loan isn’t viable.

The trucking company owner in 48 Hours: How a Short-Term Loan Saved My Trucking Company faced exactly this scenario. When equipment fails, fast funding often makes the difference between surviving and shutting down.

Payroll Gaps

A major client pays late. A big project finishes, but payment won’t arrive for 60 days. Meanwhile, your employees expect their checks on Friday. Missing payroll is catastrophic for morale and retention, and in many states, it’s illegal.

Emergency funding bridges the gap between when money is owed to you and when you owe money to others.

Unexpected Expenses

The roof leaks. A lawsuit demands an immediate settlement. A key supplier requires payment before continuing. Regulations change, and compliance requires investment. Life throws curveballs that cash reserves can’t always cover.

Inventory Opportunities

A supplier offers a massive discount on inventory, but only if you pay within 48 hours. A competitor is liquidating, and you can buy their stock at pennies on the dollar. Time-sensitive opportunities require time-sensitive capital.

Seasonal Cash Crunches

Seasonal businesses know the slow periods are coming, but sometimes they hit harder than expected. A landscaping company needs to survive winter. A beach rental business needs to bridge the gap between summers. Emergency funding keeps the lights on until revenue picks up.

Customer Defaults

A major customer goes bankrupt owing you significant money. A project gets canceled mid-stream. Revenue you were counting on vanishes, but your expenses remain.

Expansion Pressures

You land a contract bigger than anything you’ve handled before. Great news, except you need to hire people, buy materials, and scale up before you’ll see payment. Growth can create cash flow emergencies as surely as problems can.

Ready to get started?

Types of Emergency Business Funding Options

Several products can serve emergency funding needs. Each has different characteristics.

Short-Term Business Loans

Short-term loans provide a lump sum you repay over three to 24 months. Payments are typically daily or weekly. This is one of the most straightforward emergency funding options.

The application process is simple. Most lenders need bank statements and basic business information. Approval happens in hours. Funding follows the same day or the next business morning.

Short-term loans work well for defined needs with clear repayment paths. You know what you need, you know the purpose, and you know how you’ll pay it back.

Business Lines of Credit

A business line of credit gives you access to a pool of funds you can draw from whenever you need them. Unlike a loan, you don’t take the full amount upfront. You draw what you need, pay interest only on what you use, and the credit becomes available again as you repay.

Here’s the key insight: the best time to establish a line of credit is before you need it. If you wait until an emergency hits to apply, you’re adding application time to your crisis. If you already have an approved line sitting unused, you can draw funds immediately when something goes wrong.

Many experienced business owners maintain a line of credit specifically for emergencies. It’s like insurance you pay for only when you use it.

Merchant Cash Advances

MCAs advance money against your future sales. Repayment happens automatically as a percentage of daily credit card transactions or through fixed daily debits.

As we covered in our merchant cash advance vs business loan comparison, MCAs are easier to qualify for than loans, but typically cost more. They fund very quickly and work particularly well for businesses with strong credit card volume.

For emergencies where speed and accessibility trump cost concerns, MCAs often come through when other options don’t.

Invoice Factoring

If your emergency stems from slow-paying customers, invoice factoring converts outstanding invoices into immediate cash. You sell your receivables to a factoring company at a discount and get money now instead of waiting 30, 60, or 90 days.

This only works if you have invoices to factor. But for B2B businesses with receivables tied up in slow payment cycles, factoring provides emergency liquidity without taking on new debt.

Equipment Financing

If the emergency involves equipment, some equipment financing options move quickly. The equipment itself serves as collateral, which can simplify approval. This works for replacing failed equipment or purchasing equipment to meet a sudden need.

How Quickly Can You Get Emergency Business Funding

Speed varies by lender and product, but the fastest options can fund within hours.

Same-Day Funding

Many alternative lenders offer same-day funding for applications completed early in the day with complete documentation. Apply by 10 AM with your bank statements ready, get approved by noon, and receive funds by the end of business.

This isn’t guaranteed. Complex applications take longer. Missing documentation creates delays. Bank wire cut-off times affect when money actually hits your account. But for straightforward applications, same-day is genuinely achievable.

Next-Day Funding

More commonly, expect funds within 24 hours. Apply today, get funded tomorrow morning. This timeline works for most emergencies that aren’t literally happening in the next few hours.

48-Hour Funding

Some situations take a bit longer. More complex applications, larger loan amounts, or lenders with slightly longer processes might take two business days. Still dramatically faster than traditional bank timelines.

As we detailed in our guide to how to get a business loan in 24 hours, preparation is the biggest factor in funding speed. Business owners with documents ready move through the process faster than those scrambling to find paperwork mid-application.

Qualification Requirements for Emergency Loans

Emergency lenders prioritize speed, which means streamlined qualification. Requirements are typically less demanding than traditional financing.

Time in Business

Most emergency lenders require six months. Some accept businesses as young as three or four months if revenue is strong. Startups with no operating history have very limited options.

Monthly Revenue

Revenue minimums typically fall between $10,000 and $15,000 per month. Higher revenue opens up larger loan amounts and potentially better terms. Your bank statements prove this.

Credit Score

Here’s where emergency lenders differ most from banks. Many work with scores as low as 500 to 550. Some focus so heavily on revenue that credit becomes almost secondary.

Our guide to business loans with a 500 credit score covers this in detail. Bad credit doesn’t automatically disqualify you from emergency funding. Strong business performance can compensate for weak personal credit.

Bank Account Health

Lenders review your bank statements for consistent deposits, healthy balances, and clean activity. Overdrafts, returned payments, and erratic cash flow raise concerns. Keeping your banking clean strengthens any funding application.

Industry

Most industries qualify, though some lenders have restrictions. Certain high-risk categories might face additional scrutiny or limited options.

Need Funds Quickly?

Documents Needed for Fast Emergency Funding

The documentation burden for emergency loans is deliberately light. Speed requires simplicity.

Bank Statements

This is the essential document. Three to six months of statements from your business checking account. Download them as PDFs before you need them. Having these ready can shave hours off your funding timeline.

Government ID

Driver’s license or passport. Current and legible.

Business Information

Legal business name, EIN, business address, formation date, and ownership details. Nothing complicated, but have it accessible.

Voided Check

Some lenders request this to verify your bank account details and set up the wire transfer.

That’s typically it. No tax returns. No audited financials. No business plans or projections. The streamlined requirements are specifically designed to enable fast decisions.

Costs and Terms of Emergency Business Loans

Emergency funding typically costs more than patient, planned borrowing. Understanding the cost structure helps you make informed decisions.

Interest Rates and Factor Rates

Short-term emergency loans might carry APRs ranging from 20% to 50% or higher, depending on your profile and the lender. MCAs use factor rates typically between 1.2 and 1.5, which translate to even higher effective APRs over short repayment periods.

Compare this to bank loans at 7% to 12% APR, and the premium is obvious. You’re paying for speed, accessibility, and the lender’s willingness to take risks that banks won’t.

Repayment Terms

Emergency loans often have shorter terms than traditional financing. Three to eighteen months is common. Payments are frequently daily or weekly rather than monthly.

Shorter terms mean higher payments relative to the loan amount, but they also mean you’re done faster. Some business owners prefer getting the debt cleared quickly rather than carrying it for years.

Total Cost Calculation

Always calculate the total repayment before committing. If you’re borrowing $30,000 and will repay $39,000, the cost is $9,000. Is solving your emergency worth $9,000? That’s the real question.

Sometimes yes. Keeping your business open, retaining employees, capturing an opportunity, or avoiding a larger loss can easily justify the cost. Other times, the emergency might be addressable through other means that cost less.

How to Prepare for Future Business Emergencies

The best emergency is one you’re prepared for. A few strategies reduce your vulnerability.

Establish a Line of Credit Now

Don’t wait until you need money to apply for a line of credit. Get approved while business is good, and your application is strong. Leave the line untouched until you need it.

When an emergency hits, you’ll have immediate access to capital without any application process. The line is already there, waiting.

Martin’s construction business success story illustrates this perfectly. Having a line of credit in place before the opportunity arose allowed him to act immediately when it mattered.

Build Cash Reserves

Easier said than done, but critical. Even one or two months of operating expenses in reserve changes your options dramatically. You can absorb smaller emergencies without borrowing and have runway to arrange better terms for larger ones.

Know Your Funding Options

Research lenders before you need them. Know who offers what you’d qualify for. Have documentation organized and accessible. When an emergency strikes, you’ll move faster because you’ve already done the homework.

Maintain Clean Financials

Keep your bank account healthy. Avoid overdrafts. Keep books reasonably organized. Clean financials make every funding application smoother and faster.

Diversify Revenue Sources

Dependence on a single customer or revenue stream creates vulnerability. If that customer fails or that stream dries up, you’re in crisis. Multiple revenue sources provide stability.

Insurance Coverage

Proper business insurance can cover certain emergencies. Equipment breakdown, business interruption, and liability claims. Insurance won’t help with every situation, but it prevents some emergencies from becoming funding crises.

How to Apply for Emergency Business Funding

When an emergency hits, here’s how to move quickly.

Step 1: Assess the Situation

How much do you actually need? Be realistic. Overborrowing increases your costs and repayment burden. Underborrowing might leave you short.

Step 2: Gather Documents

Bank statements, ID, business information. If you’ve followed our advice and prepared these in advance, you’re ready. If not, gather them now.

Step 3: Choose Your Lender

Look for lenders who emphasize speed and work with your credit profile. Apply to one or two promising options rather than spraying applications everywhere.

Step 4: Complete the Application

Fill out everything completely and accurately. Inconsistencies or incomplete information create delays.

Step 5: Submit Documentation Immediately

When the application asks for bank statements, upload them right then. Don’t plan to finish later. Every hour matters in an emergency.

Step 6: Stay Available

Keep your phone handy and check email frequently. If the lender has questions, respond immediately. Being unreachable adds hours or days to your timeline.

Step 7: Review and Accept

When you receive an offer, review the terms. Understand total repayment, payment schedule, and any fees. If acceptable, sign and complete the final steps.

Step 8: Receive Funds

Once everything is signed and verified, funds will be transferred to your account. Most emergency loans are funded within 24 hours of approval.

💡 Pro Tip

The smartest funding decisions come from understanding the full cost, not just the monthly amount. Visit our guides for more exclusive tips.

Frequently Asked Questions About Emergency Business Loans

How fast can I actually get emergency funding?

With complete documentation and a straightforward application, funding can happen the same business day. More commonly, expect funds within 24 to 48 hours. The biggest factor is how prepared you are with documentation.

What credit score do I need for emergency business loans?

Many emergency lenders work with scores as low as 500. Credit matters, but revenue and cash flow often matter more. Don’t assume your credit disqualifies you without checking.

Do emergency loans require collateral?

Most don’t. Emergency funding from alternative lenders is typically unsecured, based on your revenue rather than the assets you pledge. A personal guarantee is common, which is different from collateral.

How much can I borrow for an emergency?

Amounts typically range from $5,000 to $500,000, depending on your revenue and business profile. First-time borrowers might face lower limits until they establish a payment track record.

Will an emergency loan hurt my credit?

Most alternative lenders use soft credit pulls during the application phase, which don’t affect your score. Hard inquiries typically happen only after you accept an offer.

What if I’m already carrying business debt?

Additional debt on top of existing obligations is possible, but is scrutinized carefully. Lenders evaluate whether your cash flow can handle combined payments. Too much stacking can lead to decline.

Can I get emergency funding on weekends?

Applications can be submitted anytime, but funding depends on banking hours. A weekend application likely won’t fund until Monday, when the wire transfer process.

What’s the difference between emergency loans and regular business loans?

The product is often the same. “Emergency loan” describes the use case and timeline, not a distinct product category. The same short-term loan used for a planned inventory purchase can be an emergency loan when used for urgent equipment repair.